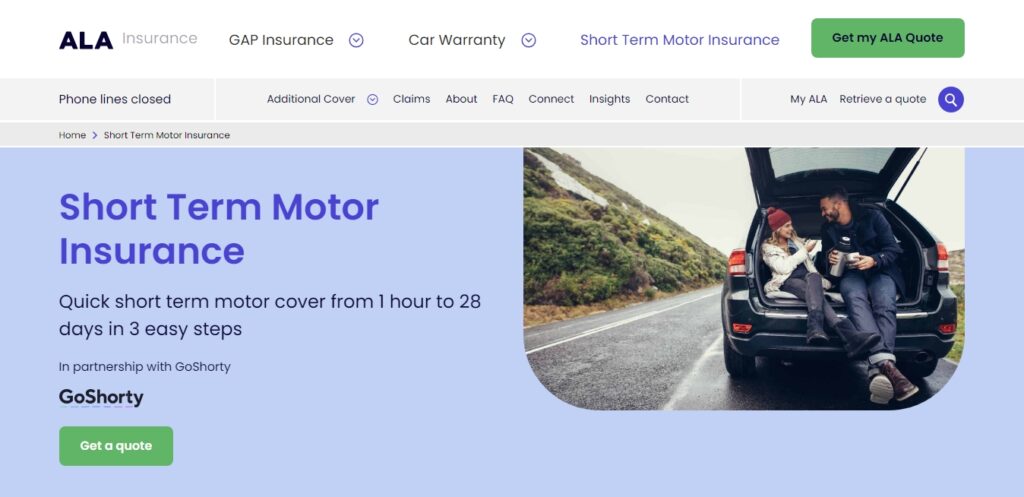

Whether you need temporary car insurance for an hour or up to 28 days, ALA Insurance has you covered with their new short term motor insurance policies. In partnership with the trusted provider GoShorty, ALA is making it easier than ever to get quick and comprehensive coverage when you need it most.

What is Short Term Motor Insurance?

Short term motor insurance, also called temporary car insurance, provides flexible vehicle coverage for a specified short period of time. Rather than committing to an annual policy, you can insure a car or van for periods ranging from just 1 hour up to 28 days through ALA. It’s the affordable, commitment-free way to drive when you need to.

There are many situations where short term cover comes in handy, such as moving house and needing to borrow a van, learning to drive, having an emergency require you to drive someone else’s vehicle, or test driving a car you’re interested in purchasing privately.

The Benefits of Short Term Cover from ALA

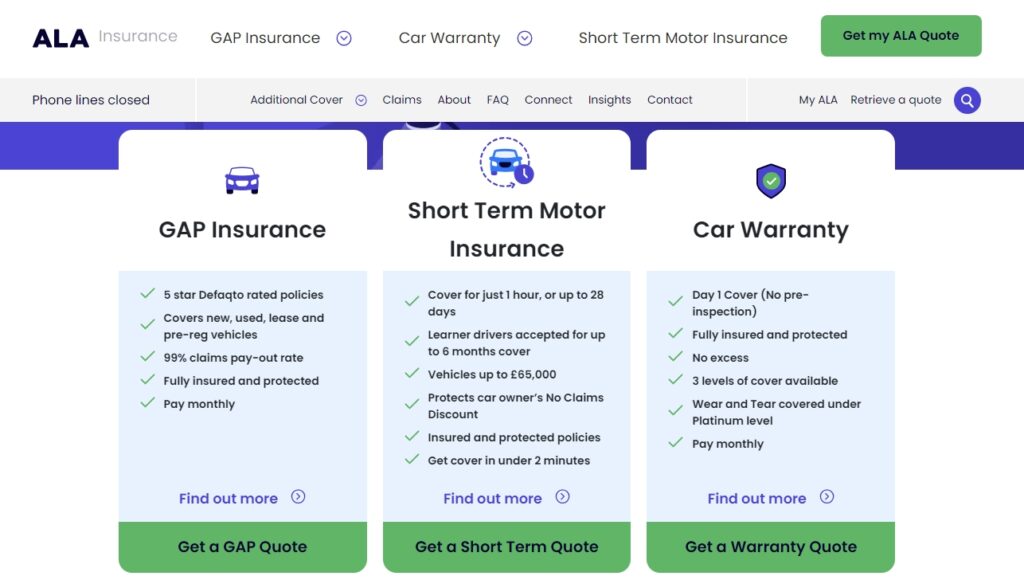

By partnering with GoShorty, a leader in short term motor policies, ALA Insurance is able to offer customers a market-leading comprehensive temporary insurance solution with a host of great benefits:

1. Lightning Fast Cover

One of the biggest advantages is just how quickly you can get insured with ALA. It takes under 2 minutes to get a quote and be covered. There’s no hanging around waiting for months of paperwork – just get insured and hit the road!

2. Unbeatable Flexibility

Need cover for just an hour? A day? A week? Maybe even up to 6 months if you’re a learner driver? ALA’s short term policies let you choose exactly how long you need coverage for so you don’t pay a penny more than necessary.

3. Low Excess Rates

The policies offer a low excess rate, potentially saving you hundreds if you do need to make a claim compared to a traditional annual policy excess costs.

4. Wide Vehicle & Driver Acceptance

Cars, vans, learners – ALA and GoShorty can provide short term cover for a wide range of vehicles and driver situations. They’ll even insure cars up to £65,000 in value.

5. 5-Star Rated Support

Should you ever have any queries, you’ll get excellent support from ALA’s 4.9/5 rated team on Trustpilot (from over 17,000 reviews!). GoShorty also has a 4.9/5 excellent rating for their customer service.

6. Protected Policies

All ALA and GoShorty policies are fully authorized and protected under the Financial Services Compensation Scheme, giving you critical peace of mind.

When Would I Need Short Term Cover?

There are numerous situations where short term motor insurance from ALA comes in handy and can save you money compared to alternatives like getting added to someone’s annual policy. A few common examples include:

- An infrequent driver who only needs cover occasionally

- Borrowing a friend or family member’s car or van

- Sharing driving duties on a long road trip

- Using a courtesy car from a garage

- An emergency requiring you to drive someone else’s vehicle

- A young driver back home from university for a visit

- Collecting, delivering or test driving a new vehicle purchase

- Learner drivers who need insurance for practice

The list goes on and on! Essentially, any time you need to drive a vehicle you don’t normally have insured, ALA’s short term cover can fill that temporary gap in an affordable, perfectly customized way.

Why Choose ALA’s Partnership with GoShorty?

At ALA Insurance, they are committed to providing customers with proven, industry-leading cover crafted with expertise and care. Their partnership with GoShorty for short term motor policies allows them to live up to that commitment.

GoShorty is an FCA authorized provider specializing in high quality temporary vehicle insurance. They have an established reputation for:

- Competitive policy pricing

- Comprehensive coverage terms

- Lightning fast issue of policies

- Exceptional customer support

ALA chose GoShorty as their partner for short term motor cover after vetting numerous potential providers. GoShorty’s focus on value, convenience and service for customers aligns perfectly with ALA’s own mission.

On ALA’s end, they bring 50+ years of experience crafting top-tier insurance products to the partnership. Their salaried support staff provide unparalleled, unbiased guidance – not pushy sales tactics. They are there to make sure you get the perfect short term policy to meet your needs.

Get a Quick Quote Today

Ready to experience the convenience, affordability and quality of ALA’s short term motor insurance? Head over to their quick quote tool and you could be fully insured in just a couple of minutes! ALA’s policies give you the freedom to drive with comprehensive peace of mind, without any long-term commitments or unnecessary costs.

So what are you waiting for? Get an instant quote on short term cover from 1 hour up to 28 days right now. Let ALA and GoShorty protect you on the road with their short term motor insurance policies.