As motorists, there is that sinking feeling that we all experience when, for instance, our car is involved in an accident, gets stolen or is a total loss. Not only is it such a headache and so stressful, but it also leaves you in a very vulnerable position if your insurance claim does not sufficiently compensate your car. That is why GAP (Guaranteed Asset Protection) insurance from ALA is needed—to protect the client and fill this gap.

What Exactly Is GAP Insurance?

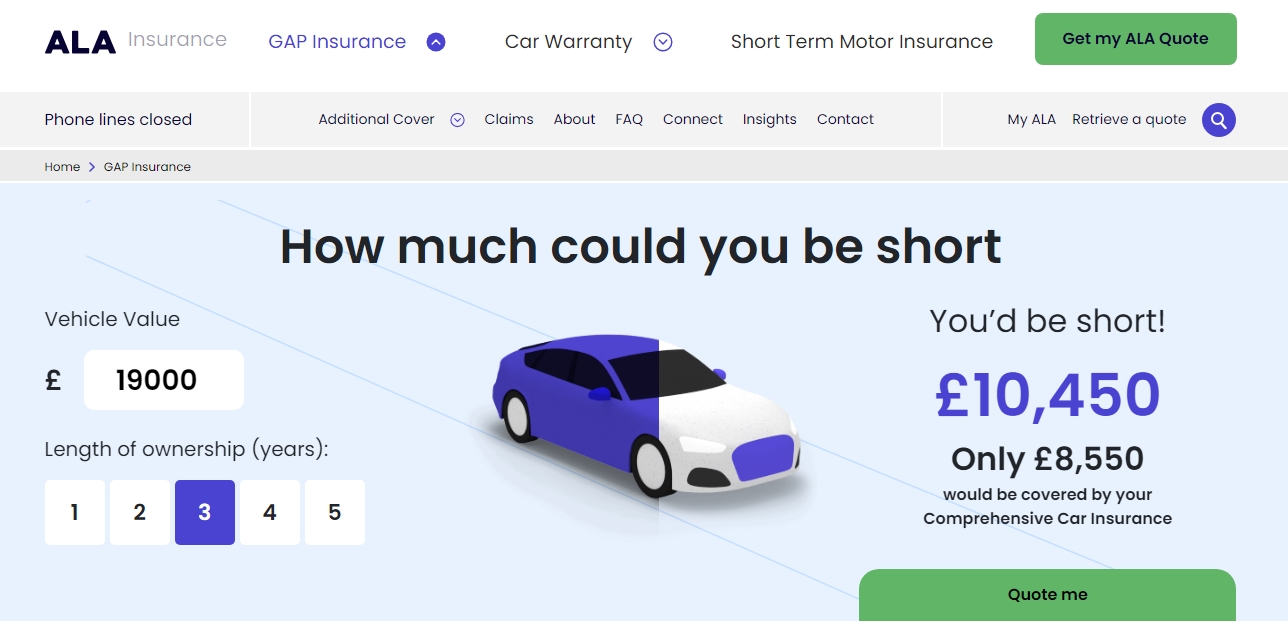

In layman’s terms, GAP insurance protects you in the event that your car is written off or stolen by providing for the difference between what you paid for your car and what your insurance company will pay out. It is rather shocking to learn that cars can lose as much as 70% of their worth within only three years after they have been bought new. A used car depreciates very quickly; in fact, an average used car could have depreciated by 20% within the first six months of its sale. Thus, if the worst befalls you shortly after the purchase, you can end up losing thousands of your hard-earned money.

GAP insurance covers this car value drop and guarantees enough money to pay for the remaining amount of the finance and buy another car without ending up in a financial loss. However, not everyone will have to. The bitter truth is that the car theft rate has increased by 7% in 2018 and 30% in 2015. Since one of the crimes mentioned happens to be carjacking, it is always wise to be prepared for the worst.

The Different Types Explained

Like most insurance products, there are a few different GAP policy options to choose from depending on your specific circumstances: Like most insurance products, there are a few different GAP policy options to choose from depending on your specific circumstances:

Finance GAP: payment for any remaining finance if your car is a write but does not include any negative equity from the previous agreement.

Negative Equity GAP: Adds any amount of negative equity from the previous car to the finance cover of the new car.

Return to Invoice GAP: This protects the difference between the amount the insurer will pay and the invoice price that was paid for the car.

Vehicle Replacement GAP: Pays out enough to ensure your total written-off vehicle is replaced by a brand new model in the same make and specification.

Return to Value GAP: This is the value that is assigned to the car by the insurer and the value of the car at the time you bought it, whether brand new or used.

Lease GAP: This is for those people who lease their car rather than own it; in the event that the car is a total loss, then this company will pay the remaining amount that one was to pay to the leasing company.

As we can note, there is GAP insurance for all situations, whether you purchased a new or a second-hand car, whether you financed or leased the car. If you are unsure as to what level of coverage you require, then you can speak with one of ALA’s team of specialists, who will be able to advise you as to what is most suitable for your circumstances.

What Else Does ALA Offer?

Their GAP insurance is great if you want to safeguard your investment in case of a write-off, but ALA also offers a whole range of other smart and cheap products to keep your pride and joy looking as good as the day you bought it.

Their Scratch & Dent cover is for the ugly side of car damages, while the tyre and alloy policy pays for scuffs, puncture and even the theft of your fancy rims. Oh yes, there is Keycare insurance in case you lose your keys and, believe it or not, there is an excess policy to meet the compulsory and voluntary excess if you should need to make a claim.

These cheap extras are great and offer great reassurance that even minor driving incidents do not necessarily have to result in expensive car repairs. Indeed, cars are among the biggest purchases a person makes after a home, which is why they should be adequately insured.

Is GAP Insurance Worth It?

Whether GAP insurance is right for you really depends on your individual circumstances, but there are some general guidelines to consider:

GAP insurance offers the most value when you are insuring a new car, as cars tend to depreciate quickly within the first few years.

If, for instance, you have taken out a long finance agreement on a new car, GAP Cover ensures that after an insurance settlement, you are not left with any balance.

Bought-for-cash cars older than 3 years may not require GAP insurance as the depreciation rate is slower in the initial years.

Some manufacturers’ insurance packages will provide for a new car in the event of a write-off in the first year, negating the need for GAP but read the small print carefully.

The team at ALA can explain the advantages and disadvantages of GAP insurance to help you decide whether it is worth it, depending on the circumstances.

What Isn’t Covered?

As you’d expect, there are certain scenarios where GAP insurance won’t pay out, which is useful to be aware of:

It only applies if you have a fully comprehensive insurance policy already on your car. However, if your insurer does not write your car off as a complete loss, GAP insurance will not pay for repairs. There are circumstances in which, when you use your car for competitions or races, your GAP cover is automatically null and void. There is no consideration for anything that you may have added or changed after buying the car—only the basic value of the car.

Fear not; if the unfortunate time ever comes that you have to make a claim, ALA will assist you through the process and make sure that you get everything that is rightfully yours.

Why Choose ALA?

In an industry where the wrong advice or cover can prove costly, you need a GAP insurance provider you can really trust. ALA have been protecting British motorists for years with their first-class, fairly priced insurance products.

Their experienced advisors don’t work on commission, so you can be confident their recommendations are 100% impartial – just friendly, professional guidance to find the perfect cover. They believe in putting customers first with top-notch service at all times.

If you need to make a claim, you’ll find the process refreshingly hassle-free thanks to ALA’s dedicated team handling everything quickly and efficiently. No jumping through hoops, just great value cover you can rely on when it counts.

So for complete peace of mind about your car’s value, as well as protecting it from life’s little motoring mishaps, look no further than ALA’s GAP insurance and protection products. You can get an instant online quote right now to see how affordable it is to properly safeguard your pride and joy. Get ALA Quote!